Every tax year I receive a few calls from taxpayers asking the County Treasurer to lower or waive their property taxes for various reasons.

County treasurers does not have the legal authority to lower property taxes or waive property taxes per state law.

The Treasurer’s Office and the state of Colorado do have programs available for seniors or people with disabilities. More information is

available on these programs at the following link: https://www.jeffco.us/2416/Help-for-Seniors-People-with-Disabilitie

If you believe your property has been incorrectly valued or classified, you may can also file an appeal with the County Assessor. For

information on this process, please view this link: https://www.jeffco.us/431/Appeals

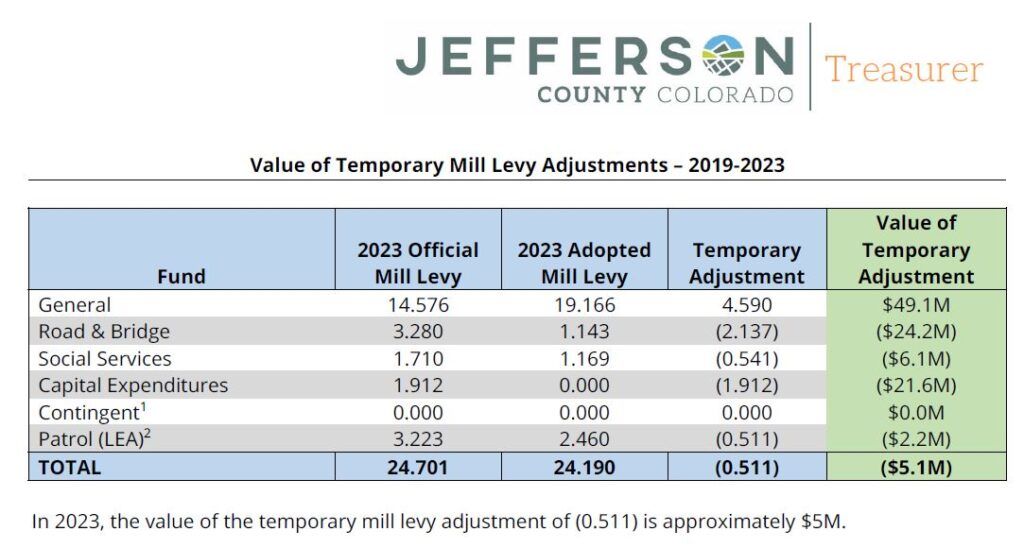

The TABOR Value of Temporary Mill Levy Adjustment report for 2023 has been posted on the JeffCo Treasurer’s web page. This easy-to-read

report is crystal clear on the impacts of the TABOR revenue cap on the County’s budget and the ability to provide services/projects for

County residents and businesses.

For example, in 2023 the County will not legally collect $5.1 million in revenue that could be used for a variety of services and projects in Jefferson County. See this link: https://www.jeffco.us/DocumentCenter/View/37784/TABOR-Value-of-Temporary-Mill-Levy-Adjustment-2019-2023-PDF

What is TABOR? See: https://www.jeffco.us/3994/What-is-TABOR

Contact Jefferson County Treasurer Jerry DiTullio at 303-271-8337 or www.jeffco.us/Treasurer