Hello JeffCo, happy New Year!

The Neighborhood Gazette has requested an update on the finances of Jefferson County Government (JeffCo). While JeffCo finance is a long and continuing discussion, I can update JeffCo taxpayers and residents on some key points about JeffCo.

The Taxpayer’s Bill of Rights, or TABOR, is an amendment to the Colorado Constitution enacted by voters in 1992 that limits the amount of revenue governments in Colorado can retain and spend, including the state, counties, cities, schools and special districts. Limiting how much total revenue can be received by these local governments each year can have different effects on their budgets. While a majority of counties, cities and special districts have opted out of TABOR via a vote of their constituents, JeffCo and the state of Colorado are still operating under TABOR. For example, the City of Wheat Ridge voters opted out of TABOR years ago when I was still an elected official in Wheat Ridge.

JeffCo government provides many services such as Public Health, Human Services, law enforcement via the Sheriff and deputies in unincorporated JeffCo, the County Coroner, Assessor, Treasurer, Clerk and Recorder and Open Space to name a few. If you live in unincorporated JeffCo, your “city council” is the Board of County Commissioners. JeffCo supports all of the cities, towns and special districts in JeffCo as well. Special Districts include, but are not limited to, fire departments, water, sewer and the school district. To be crystal clear, JeffCo and the Jefferson County School District are not the same entity. While the County Treasurer collects funds from property taxes for the school district, the school district has its own governing body (school board) and does not answer to JeffCo. While JeffCo continues to pay its bills every month, the TABOR umbrella restricts JeffCo from implementing new projects and services in a timely manner. In 2022 JeffCo asked the voters to be exempted from most of the TABOR umbrella (ballot question 1A). The ballot question failed by approximately 3,000 votes. Any ballot questions for JeffCo that are placed on the ballot must be initiated and approved by the Board of County Commissioners.

More information on TABOR: https://www.jeffco.us/3994/What-is-TABOR

More information on your TABOR refund from JeffCo: https://www.jeffco.us/4517/2022-TABOR-Refunds

How Do Property Taxes Work?

Property taxes fund critical services from special districts such as our school district, fire departments, public works, water, sewer, public safety, etc. For every dollar of property tax collected, 24 cents goes to JeffCo for services and projects. The other 76 cents funds the services and projects of special districts.

The JeffCo Treasurer’s Office uses a third-party vendor to collect property taxes online. The third-party vendor charges a vendor or “convenience” fee for their services. The fee goes directly to the vendor, not the Jefferson County government. I have been able to negotiate a lower fee for credit card payments online. The credit card fee has been 2.5 percent of the property tax due, and now is 2.35 percent of property tax due.

3rd Party Online Payment Fees for Property Taxes (2023):

• Credit Card – 2.35 percent of property tax due (was 2.5 percent)

• Debit Card – $3.95 per property tax payment

• E-Checks – No Charge

For more information about third party vendor fees please contact the Treasurer’s Office at 303-271-8330.

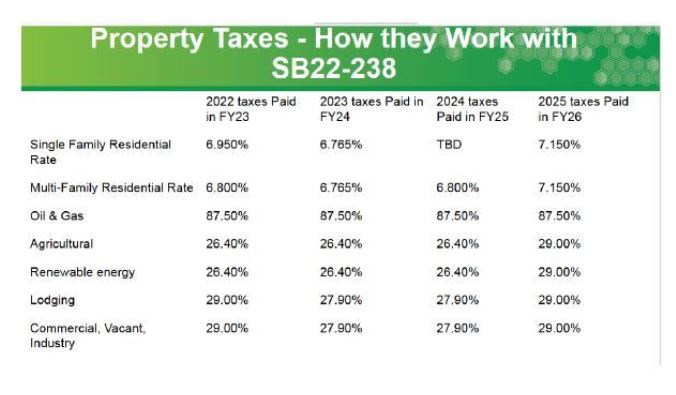

*As a result of the passage of SB21-293 (in 2021), and due to the failure of Proposition 120, changes to the property tax assessment rates will take effect for tax year 2022 payable 2023. The passage of SB22-238 (in 2022) changed the assessment rates for tax years 2023, 2024 and 2025.

As you can see in the accompanying chart, property tax rates decrease depending on the property type and fiscal year. Generally speaking, most residential property tax bills will be less in JeffCo (approx. $25-$100 less) when they were mailed in January by the Treasurer’s Office.

*Please note that some properties may not see a decrease in the property tax bill because of the circumstances of that specific property.

Contact JeffCo Treasurer Jerry DiTullio at 303-271-8337 (office) or www.jeffco.us/Treasurer.